About Culture Corporate Responsibility Press Investors

Contents

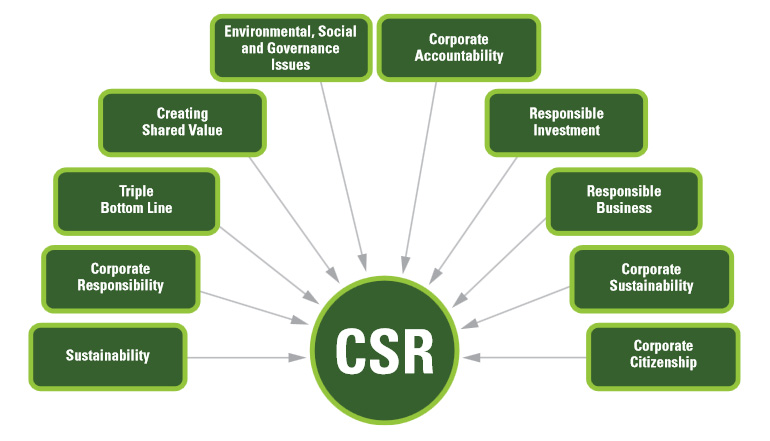

The purpose of this paper is to determine the direct influence of the mechanism of good corporate governance and corporate social responsibility on financial performance as well as through earnings management as a mediating variable. Proponents argue that corporations increase long-term profits by operating with a CSR perspective, while critics argue that CSR distracts from businesses’ economic role. Or that CSR is merely window-dressing, or an attempt to pre-empt the role of governments as a watchdog over powerful multinational corporations. In line with this critical perspective, political and sociological institutionalists became interested in CSR in the context of theories of globalization, neoliberalism, and late capitalism.

The effectiveness of supervisory functions by the board of commissioners requires high independence. Based on the description that has been disclosed, the authors are interested to examine the effect of GCG and CSR on financial performance by incorporating earnings management as a mediation variable. This paper will be followed by an overview of literature review, research methods, results and discussion and conclusions. Research on the effect of GCG on the firm performance has been conducted extensively. The presence of good corporate governance is absolutely required by an organization, considering GCG requires a good governance system which can assist in building shareholder confidence and ensure that all stakeholders are treated equally. A good system will provide effective protection to shareholders to recover their investment reasonably, appropriately and efficiently, and ensure that management acts for the benefit of the company.

- Profit is the economic value created by the organization after deducting the cost of all inputs, including the cost of the capital .

- Performance is an illustration of the activity implementation achievement in realizing the objectives of the firm; one of the important goals of the establishment of a company is to maximize shareholder wealth through increasing the value of the company .

- A large body of literature exhorts businesses to adopt non-financial measures of success (e.g., Deming’s Fourteen Points, balanced scorecards).

- The difference between these two accounting methods is the treatment of accruals.

- Beyond this, some companies are innovating to find new ways to further improve the integrity of renewable energy procurement.

Job security, wage increases with industry growth are key aspects of collective bargaining in the German labor system. CEOs’ political ideologies are evident manifestations of their different personal views. Each CEO may exercise different powers according to their organizational outcomes. Their political ideologies are expected to influence their preferences for CSR outcomes. Proponents argue that politically liberal CEOs will envision the practice of CSR as beneficial and desirable to increase a firm’s reputation. As a consequence, they will advance with the practice of CSR while adding value to the firm.

Do I need to use disclaimers?

Accountants employed by federal, state, and local governments ensure that revenues are received and spent according to laws and regulations. Their responsibilities include auditing, financial reporting, and management accounting. This module is case study based and designed to equip students with the practical research skills needed to understand many contemporary problems faced by managers and accountants in a modern economy. The course locates key accounting and finance issues within a changing organizational and societal context. Accountants help businesses maintain accurate and timely records of their finances.

The accounting, auditing, and reporting resources provide a foundation for consumers to verify that their products are socially sustainable. Due to an increased awareness of the need for CSR, many industries have their own verification resources. They include organizations such as the Forest Stewardship Council , International Cocoa Initiative, and Kimberly Process . The United Nations Global Compact provides frameworks not only for verification, but also for reporting human rights violations in corporate supply chains. Public accountants work with financial documents that clients are required by law to disclose, such as tax forms and financial statements that corporations must provide to current and potential investors.

Our students quickly become familiar with the challenges faced by professional accountants. As your confidence grows, you’ll develop your own views on how to approach these challenges. Generally speaking, however, attention to detail is a key component in accountancy, since accountants must be able to diagnose and correct subtle errors or discrepancies in a company’s accounts. Mathematical skills are helpful but are less important than in previous generations due to the wide availability of computers and calculators. To illustrate double-entry accounting, imagine a business sends an invoice to one of its clients.

The measurement results of performance achievement serve as the basis for management or manager of the company to improve performance in the next period and be used as the basis of reward and punishment. Freeman concluded that the real purpose of a company is to meet the needs of stakeholders, i.e. those affected by the decisions taken by the company. Gray et al. said that the survival of a company depends on the support of its stakeholders, and that support should be sought so that the company should seek that support. Jensen and Meckling describe the agency relationship as a relationship between the company owner and the agent, with the delegation of the decision-making authority to the agent. In an agency relationship, there may be a conflict of interest between the principal and the agent.

All states require CPAs to take continuing education courses, including ethics, to maintain their license. A few states allow a number of years of public accounting experience to substitute for a college degree. Accountants and auditors typically need a bachelor’s degree in accounting or a related field, such as business. Some employers prefer to hire applicants who have a master’s degree, either in accounting or in business administration with a concentration in accounting.

CSR critics such as Robert Reich argued that governments should set the agenda for social responsibility with laws and regulations that describe how to conduct business responsibly. Corporate social responsibility has been defined by Sheehy as «international private business self-regulation.» Sheehy examined a range of different disciplinary approaches to defining CSR. The definitions reviewed included the economic definition of «sacrificing profits,» a management definition of «beyond compliance», institutionalist views of CSR as a «socio-political movement» and the law’s focus on directors’ duties. Further, Sheehy considered Archie B. Carroll’s description of CSR as a pyramid of responsibilities, namely, economic, legal, ethical, and philanthropic responsibilities. While Carroll was not defining CSR, but simply arguing for the classification of activities, Sheehy developed a definition differently following the philosophy of science—the branch of philosophy used for defining phenomena. Social responsibility accounting, even though used generally in the context of corporate social responsibility, involves the communication of the environmental and social effects of a firm’s economic steps.

CSR can enhance a brand’s reputation by «inducing a desire to support and help the company that has acted to benefit consumers». Develop the Social License Development Strategy to remove the negative factors and ensure the positive intention of all the social license holders to support all the business objectives of the company. The rise of ethics training inside corporations, some of it required by government regulation, has helped CSR to spread. Such training aims to help employees make ethical decisions when the answers are unclear. The most direct benefit is reducing the likelihood of «dirty hands», fines, and damaged reputations for breaching laws or moral norms. CSR may be based within the human resources, business development or public relations departments of an organisation, or may be a separate unit reporting to the CEO or the board of directors.

It is an applied unit, and, although a high level of mathematical knowledge is not needed, students taking the unit must be numerate and capable of logical thinking. The resulting understanding and skills of critique will enhance students’ capabilities to reflect on the more specialist bodies of knowledge encountered in financial management and finance units in subsequent semesters. The unit uses a combination of conventional lectures to familiarise students with ideas and tutorials in which students are encouraged to show their understanding of and critically evaluate content of lectures. Socially-responsible financial management is also an important part of the course and you’ll explore the impact of financial decisions on societal welfare, the environment and company shareholders. Financial accounting is the process of recording, summarizing and reporting the myriad of a company’s transactions to provide an accurate picture of its financial position.

Government activity

We’ve also put together a Sample Disclaimer Template that you can use to help write your own. The Pay tab describes typical earnings and how workers in the occupation are compensated—annual salaries, hourly wages, commissions, tips, or bonuses. Within every occupation, earnings vary by experience, responsibility, performance, tenure, and geographic area.

According to Ahmed and Hamdan , a key element in the effectiveness of the board of commissioners is to have an independent commissioner. Therefore, with a greater number of independent commissioners, the decision-making process will be more objective so that will improve financial performance. The Cadbury Committee defines GCG as a set of rules governing relationships between shareholders, corporate managers, creditors, governments, employees and other internal and external interest holders relating to their rights and obligations. Corporate governance arises from the interests of the company to ensure the principal/investors that the funds invested are used appropriately and efficiently. Joel Bakan is one of the prominent critics of the conflict of interest between private profit and a public good characterizing corporate officials of publicly listed corporations are constrained by law to maximize the wealth of their shareholders. This argument is summarised by Haynes that «a corporate calculus exists in which costs are pushed onto both workers, consumers and the environment».

It is usually done with respect to a specific interest group or towards the society at large. The focus on multinational corporations and the tools mostly include – public hearing, public audit, social audit, use of complaint box and citizen charter and public expenditure tracking survey. In general, employment growth of accountants and auditors is expected to be closely tied to the health of the overall economy.

McWilliams and Siegel noted that Waddock and Graves had not taken innovation into account, that companies that did CSR were also very innovative, and that the innovation drove financial performance, not CSR. Hull and Rothenberg then found that when companies are not innovative, a sheesh token price history of CSR does help financial performance. CAI gratefully acknowledges financial support from Wallace Global Fund and Rockefeller Brothers Fund. Public accountants, management accountants, and internal auditors may move from one type of accounting and auditing to another.

Concept of Responsibility Accounting

For the first time, the analysis includes CO2 emissions from land use and forestry, in addition to those from fossil fuels, which significantly alters the top 10. Other examples include the lead paint used by toymaker Mattel, which required the recall of millions of toys and caused the company to initiate new risk management and quality control processes. Magellan Metals was found responsible for lead contamination killing thousands of birds in Australia. The company ceased business immediately and had to work with independent regulatory bodies to execute a cleanup. Odwalla experienced a crisis with sales dropping 90% and its stock price dropping 34% due to cases of E. The company recalled all apple or carrot juice products and introduced a new process called «flash pasteurization», as well as maintaining lines of communication constantly open with customers.

The module will develop skills and understanding of a Bloomberg terminal and how to analyse and value companies using a range of techniques. The module will focus on using predominantly numerical techniques however these will be blended with other considerations which impact the value and performance of global listed companies. A wide range of global case studies will be used to demonstrate advanced valuation techniques and investment principles, thus giving students a sound grounding to take future professional qualifications with bodies such as the CFA. Tutorials will be based in a trading room enabling students to utilise a wide range of practical data sources and trading platforms, such as Bloomberg within the setting of a small and supportive class. In most cases, accountants use generally accepted accounting principles when preparing financial statements in the U.S.

Why Is Accounting Important for Investors?

The results of this study indicate that the presence of many commissioners in the company can provide a strong supervision of management in an effort to improve company performance. The role of the board of commissioners in a company is greater in performing the monitoring function of the board of directors policies implementation. The role of an independent commissioner can minimize agency issues arising between the board of directors and the shareholders. An independent board of commissioners can perform its functions to oversee the performance of the board of directors so that the performance generated is in accordance with the interests of shareholders. Research conducted by Lee et al. , Uwuigbe et al. and Kamran and Shah stated that the GCG mechanism has a negative and significant impact on earnings management.

Services

In terms of assigning “responsibility” for these emissions, this again raises difficult questions relating to colonisation and the extraction of natural resources by foreign settlers. Estonia, for example, has long relied on oil sands for most of its energy needs, meaning it has had high annual per-capita emissions. The second approach takes a country’s per-capita emissions in each year and https://cryptolisting.org/ adds them up over time, with the result, as of 2021, shown in the table, below right. This gives equal weight to the per-capita emissions of the populations of the past and of the present day. In the modern context, only one side of that relationship has full sovereignty over the CO2-emitting activities involved – though it would have been a different story under historical colonial rule.

Considered at the organisational level, CSR is generally understood as a strategic initiative that contributes to a brand’s reputation. As such, social responsibility initiatives must coherently align with and be integrated into a business model to be successful. With some models, a firm’s implementation of CSR goes beyond compliance with regulatory requirements and engages in «actions that appear to further some social good, beyond the interests of the firm and that which is required by law». Responsibility accounting refers to a system that undertakes the identification of responsibility centers, subsequently determines its objectives. It also helps in the development of processes related to performance measurement as well as the preparation and analysis of performance reports of the identified responsibility centers. The new CDP database also makes projections out to 2100 to illustrate the role of companies in addressing climate change.

Two important types of accounting for businesses are managerial accounting and cost accounting. Managerial accounting helps management teams make business decisions, while cost accounting helps business owners decide how much a product should cost. This paper aims to understand how social finance and impact measurement experts include stakeholders’ voices in valuations of social and environmental impact. Net-zero targets aim to reduce the analysed companies’ aggregate emissions by only 40% at most, not 100% as suggested by the term “net-zero”. All of the 25 companies assessed in this report pledge some form of zero-emission, net-zero or carbon-neutral target.

The financial performance of a company is determined by the extent of its seriousness to apply corporate governance. The existence of a large independent commissioner and the company’s decision to choose an external auditor with a good reputation can provide great supervision to management in order not to commit fraud in the financial statements. The existence of institutional ownership may also add to the role of supervisor as institutional investors seek to protect the rights of shareholders. Corporate social irresponsibility in the supply chain has greatly affected the reputation of companies, leading to a lot of costs to solve the problems.